Regulatory Filings & Compliance Services

In the insurance industry, compliance isn’t optional — it’s the backbone of trust.

Brokers and corporate agents operate in a highly regulated environment, where every disclosure, return, and policy guideline matters.

At My Insurance Tribe, we help insurance brokers, corporate agents, and IMFs navigate the ever-evolving IRDAI regulatory landscape with confidence. Our regulatory and compliance consultancy services are designed to simplify complex obligations, ensure timely filings, and build governance systems that sustain credibility and growth.

We don’t just help you meet compliance — we help you master it.

Our Mission

To help insurance intermediaries operate with integrity, efficiency, and compliance excellence — strengthening the trust between regulators, organizations, and policyholders.

At My Insurance Tribe, we believe good compliance isn’t about ticking boxes — it’s about building trust that lasts.

Why Choose My Insurance Tribe

Led by a Regulatory Expert: Founded by Dr. Amulya Mala Doddigarla, Ph.D. (Insurance Solvency), with over 25 years of experience in compliance, regulation, and broking leadership.

End-to-End Compliance Support: From BAP filings to internal audits — everything under one advisory roof.

Independent & Ethical: We provide unbiased consultancy with a focus on governance, not shortcuts.

Proactive Approach: We help you anticipate regulatory changes — not just react to them.

IRDAI Regulatory Filings & Returns

We assist intermediaries in preparing, reviewing, and submitting all IRDAI-mandated filings and reports, ensuring accuracy and adherence to timelines.

- Assistance with BAP (Broker Administration Portal) filings

- Quarterly and annual regulatory returns

- Compliance certificates and disclosure documents

- Renewal documentation and license maintenance

Policy, Procedure & Documentation Support kajshdu

We assist in drafting and updating mandatory internal policies, ensuring alignment with regulatory best practices.

kajshdu

- Code of Conduct and Conflict of Interest policies

- Outsourcing, grievance redressal, and disclosure frameworks

- Record maintenance and compliance manuals

- Advisory on AML, Cybersecurity, and ESG compliance

Compliance Framework Design

We help your organization establish robust compliance processes that align with IRDAI guidelines and internal governance standards.

- Internal control and audit checklist development

- Anti-Fraud Policy and KYC compliance guidance

- Risk management and data protection protocols

- Business continuity and operational control frameworks

Training & Capacity Building for Compliance Teams

We conduct compliance awareness and refresher workshops for broker and corporate agent teams — helping employees understand IRDAI requirements and their role in maintaining regulatory hygiene.

- Understanding regulatory updates and circulars

- Do’s and Don’ts of reporting and disclosure

- Ethical selling and client communication standards

- Ethical selling and client communication standards

Stay Ahead with Confidence

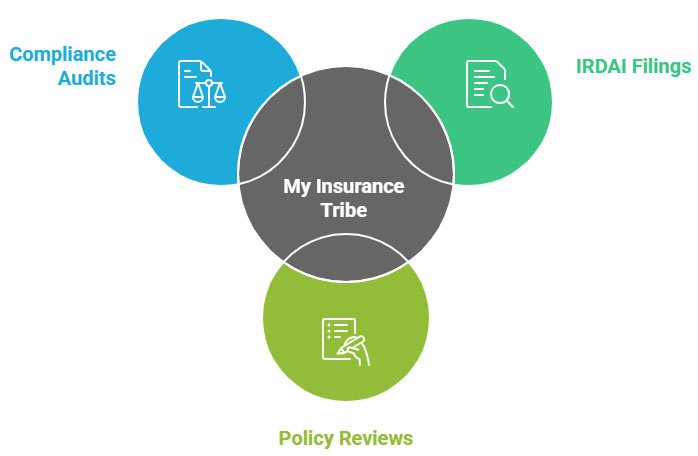

Whether you need assistance with IRDAI filings, policy reviews, or compliance audits, My Insurance Tribe is your partner in navigating India’s insurance regulatory framework with precision and peace of mind.

FAQ's

We support the full spectrum of regulatory submissions including BAP filings, quarterly and annual returns, compliance certificates, disclosure reports, renewal documentation, and all intermediary-related filings needed to stay IRDAI-compliant.

Yes. We design end-to-end compliance frameworks covering internal controls, audit checklists, KYC and anti-fraud systems, risk and data protection protocols, and operational governance structures that match IRDAI expectations.

Absolutely. We prepare and update mandatory policies such as Code of Conduct, conflict of interest, outsourcing guidelines, grievance redressal, AML, cybersecurity, ESG, and disclosure manuals tailored to your business model.

Yes. We conduct practical workshops that help teams interpret regulatory circulars, understand reporting do’s and don’ts, strengthen documentation practices, and reinforce ethical sales and communication standards.

Our services are ideal for direct and composite brokers, corporate agents, IMFs, web aggregators, and new insurance startups that want structured, reliable, and expert-led compliance support.

FAQ's

We support the full spectrum of regulatory submissions including BAP filings, quarterly and annual returns, compliance certificates, disclosure reports, renewal documentation, and all intermediary-related filings needed to stay IRDAI-compliant.

Yes. We design end-to-end compliance frameworks covering internal controls, audit checklists, KYC and anti-fraud systems, risk and data protection protocols, and operational governance structures that match IRDAI expectations.

Absolutely. We prepare and update mandatory policies such as Code of Conduct, conflict of interest, outsourcing guidelines, grievance redressal, AML, cybersecurity, ESG, and disclosure manuals tailored to your business model.

Yes. We conduct practical workshops that help teams interpret regulatory circulars, understand reporting do’s and don’ts, strengthen documentation practices, and reinforce ethical sales and communication standards.

Our services are ideal for direct and composite brokers, corporate agents, IMFs, web aggregators, and new insurance startups that want structured, reliable, and expert-led compliance support.