Insurance Claims Consultancy

But the real test begins on the day you file a claim.

Delays. Rejections. Missing documents. Confusing clauses. Endless follow-ups.

For most policyholders, a claim is not just a financial moment — it’s an emotional one.

At My Insurance Tribe, we turn that moment into clarity, confidence, and fairness.

We are an independent insurance claims consultancy led byteam of experts, in claims, solvency, regulation, and consumer protection.

We don’t sell policies.

We don’t represent insurers.

We represent YOU.

Our only job?

To make sure your claim gets the fairness it deserves — with expertise, ethics, and empathy.

Our Mission

To ensure families, businesses, and communities receive what they rightfully deserve.

To transform claim confusion into claim confidence — through knowledge, empathy, and expert support.

Why People Trust Us

Independent & Unbiased: We are NOT tied to any insurance company.

Your rights — not corporate interests — guide our decisions.

Led by True Expertise: Dr. Amulya Mala and team brings real experience from the insurance value chain, making us one of India’s most trusted insurance consultants/ advisors.

Clear Guidance, Zero Jargon: We simplify what the industry complicates.

Ethical to the Core: No shortcuts. No manipulation.

Every recommendation is transparent and honest.

Compassion + Competence: We understand that claims are personal.

You deserve a partner who listens first — and guides with heart.

Career Orientation and Awareness Sessions

Through our interactive career guidance webinars, masterclasses, and college talks, students learn:

- Why insurance is a high-potential, recession-resilient sector

- Different career paths — Underwriting, Claims, Broking, Risk Analysis, Actuarial, Compliance, and more

- Required skills, certifications, and qualifications

- How technology and innovation are reshaping insurance careers

These sessions are designed to inspire and inform — helping students see insurance as a profession of purpose, not paperwork.

Employability and Skill Development Workshops

We conduct hands-on workshops that bridge the gap between theory and practice. Topics include:

- Insurance Fundamentals for Beginners (Insurance 101)

- Understanding Claims, Risk, and Reinsurance

- Corporate Etiquette and Professional Readiness

- Communication and Compliance Skills for the BFSI Sector

These programs are not just about knowledge — they’re about confidence, clarity, and career readiness.

Personalized Career Mentorship

We offer individual and group mentorship programs to help students:

- Identify career interests within the insurance ecosystem

- Choose the right certification or training (like III, IRDAI, LOMA, or Broker exams)

- Build resumes that attract employers

- Prepare for interviews and industry placements

Every session is led by Dr. Amulya Mala Doddigarla, who brings over 25 years of experience spanning industry, research, and education — blending academic depth with real-world insights.

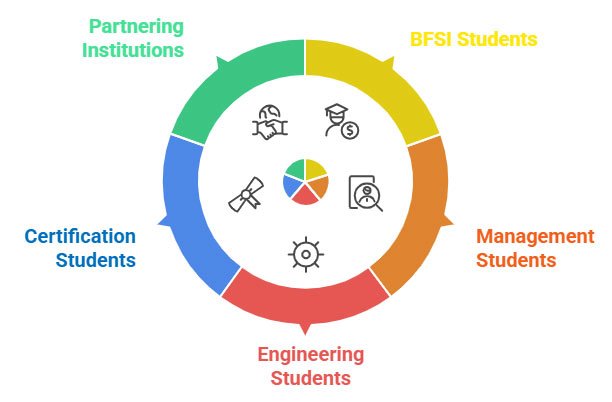

Collaboration with

Colleges and Universities

We partner with academic institutions to conduct structured career awareness programs on “Careers in Insurance and Risk Management.”

Our sessions are interactive, industry-backed, and aligned with National Skill Development and IRDAI learning goals.

Universities can collaborate with My Insurance Tribe for guest lectures, workshops, and student mentorship programs that prepare learners for a professional head start.

kajshd

What We Help With

Death claims, maturity claims, survival benefits, surrenders — we help families navigate the toughest paperwork with dignity, accuracy, and care.

Hospitalization disputes, reimbursement delays, cashless denials, deduction disputes — we guide you step-by-step until clarity is achieved.

Fire, burglary, machinery breakdown, business interruption — we assist organizations in documentation, evaluation, and dispute analysis.

PMFBY, RWBCIS and asset loss claims — we help farmers and FPOs prepare and process documentation correctly.

Rejection isn’t the end.

We examine:

- The rejection letter

- Policy terms

- Documentation gaps

- Regulatory rights

We help clients understand ombudsman pathways, internal grievances, re-examination procedures, and escalation routes — ethically and transparently.

Let’s Get Your Claim Back on Track

If you are:

- Struggling with documentation

- Unsure about the process

- Facing delays

- Received a rejection

- Or simply want expert guidance before filing

FAQ's

Yes — this is one of our most requested services.

We review the rejection letter and relevant documents, and regulatory guidelines. Then we guide you on how to re-present your case clearly and strongly through the right grievance channels (insurer, escalation, Ombudsman, etc.).

Many rejected claims simply need better documentation and correct interpretation.

- ✅Life insurance claims

- ✅Health & hospitalization claims

- ✅Commercial/Property/MSME claims

- ✅Crop & agricultural claims

- ✅Fire, burglary, machinery breakdown

- ✅Rejected, delayed, or partially settled claims

We are completely independent.

We do not sell policies and we do not represent insurance companies.

Our consultancy is unbiased and focused only on protecting your rights and helping you achieve a fair outcome.

- Policy copy

- Premium receipts

- Claim forms submitted

- Medical/hospital reports (for health claims)

- FIR, fire reports, or surveyor reports (for commercial claims)

- Communication from the insurer (emails, letters, rejection notice)

It depends on your case complexity.

Initial review typically takes 5–10 working days.

Follow-up steps (grievance, re-submission, Ombudsman) depend on regulatory timelines.

We ensure faster clarity, better documentation, and stronger case presentation, which improves the chances of timely resolution.