Arbitration & Mediation Advisory

Vision & Mission

- Educate policyholders and intermediaries on their dispute resolution rights

- Strengthen insurance literacy in ADR mechanisms

- Support research and advocacy for fair dispute settlement frameworks

Why Choose My Insurance Tribe

Independent & Impartial : We provide knowledge-based facilitation — no legal representation, no bias.

Led by Expertise : Founded by Legal expert Raju DSR and Dr. Amulya Mala Doddigarla, Ph.D. (Insurance Solvency), with deep expertise in claims, compliance, and governance.

Collaborative Network : Partnerships with experts in insurance law, regulation, and mediation.

Ethics-Driven : Our approach is rooted in fairness, education, and respect for all parties.

Advisory on Arbitration

Clauses & Processes

Many insurance policies include arbitration clauses that policyholders and institutions often overlook. We help clients understand:

- The meaning, scope, and procedure of arbitration in insurance contracts

- Rights and obligations under arbitration provisions

- When to invoke arbitration and how to prepare for it

Institutional Collaboration

My Insurance Tribe collaborates with legal experts, retired judges, academicians, and arbitrators to promote fair and transparent dispute resolution frameworks for insurance-related matters.

- Research and policy discussions on insurance arbitration

- Knowledge exchange programs with legal institutions

- Advisory partnerships for capacity building in ADR

Mediation & Pre-Arbitration Guidance

lasjkh

We encourage mediation and negotiation as the first step before escalation. Our advisors help clients and organizations prepare

- Case summaries and issue identification

- Document checklists for mediation

- Communication strategies for amicable settlement

Awareness & Training Programs

We organize workshops and webinars to build awareness among policyholders, students, and industry professionals on:

- Arbitration and mediation in insurance

- Role of ombudsman vs. arbitration

- Ethical dispute management

- ADR procedures and documentation best practices

My Insurance Tribe

Why Partner with Us

We offer unbiased education and consultancy — no policy sales, only empowerment.

Founded by Dr. Amulya Mala Doddigarla, Ph.D. (Insurance Solvency), who has worked with institutions like CESS and conducted capacity-building programs for FPO leaders and farmer groups.

We combine education, consultancy, and claims advisory to strengthen farmers’ confidence and financial resilience.

We believe insurance literacy is a key enabler of inclusive and sustainable rural development.

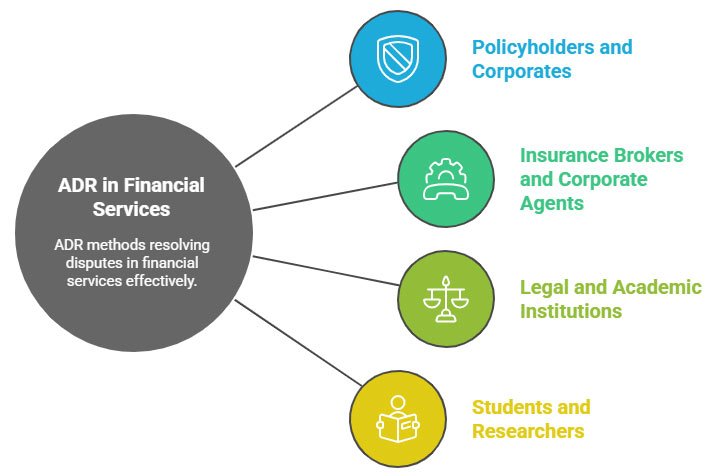

Who Can Benefit

- Policyholders and corporates facing claim disputes or contract disagreements

- Insurance brokers and corporate agents managing customer escalations

- Legal and academic institutions promoting ADR research and awareness

- Students and researchers studying arbitration in the financial services context

FAQ's

Arbitration is an alternative dispute resolution (ADR) method where a neutral third party reviews the dispute between a policyholder and insurer/intermediary and gives a decision. Many insurance policies include arbitration clauses for claim or contract disputes.

Mediation is a voluntary, collaborative process where a neutral mediator helps both parties reach an amicable settlement. Arbitration is more formal, and the arbitrator’s decision may be binding depending on the clause in the insurance contract.

No. We do not provide legal representation or act as arbitrators.

We offer independent advisory, awareness, documentation guidance, and pre-arbitration/mediation support so clients understand the process and prepare effectively.

Arbitration may be considered when:

- A claim is rejected or partially settled

- There is a dispute over policy terms or coverage

- Internal grievance and ombudsman channels have not resolved the issue

Our team helps you assess whether arbitration is appropriate in your situation.

Yes. We help clients understand:

- What the arbitration clause means

- When it can be invoked

- What procedures must be followed

- Documents needed to support the case

Yes. We guide you through:

- Preparing case summaries

- Organizing evidence and correspondence

- Documentation checklists

- Drafting communication with insurers or intermediaries

We help you present a clear, complete case while maintaining objectivity.

Yes.

We provide advisory support on:

- Eligibility for Ombudsman complaints

- Preparing submissions

- Understanding timelines and procedures

We ensure your representation is well-prepared and aligned with guidelines.

Yes — this is a core part of our mission.

We offer:

- Policy interpretation services

- Coverage and exclusion analysis

- Contract advisory

- Documentation audits

- Claims readiness assessments

Most disputes can be avoided with the right knowledge and preparation.

Arbitration is an alternative dispute resolution (ADR) method where a neutral third party reviews the dispute between a policyholder and insurer/intermediary and gives a decision. Many insurance policies include arbitration clauses for claim or contract disputes.

Mediation is a voluntary, collaborative process where a neutral mediator helps both parties reach an amicable settlement. Arbitration is more formal, and the arbitrator’s decision may be binding depending on the clause in the insurance contract.

No. We do not provide legal representation or act as arbitrators.

We offer independent advisory, awareness, documentation guidance, and pre-arbitration/mediation support so clients understand the process and prepare effectively.

Arbitration may be considered when:

- A claim is rejected or partially settled

- There is a dispute over policy terms or coverage

- Internal grievance and ombudsman channels have not resolved the issue

Our team helps you assess whether arbitration is appropriate in your situation.

Yes. We help clients understand:

- What the arbitration clause means

- When it can be invoked

- What procedures must be followed

- Documents needed to support the case

Yes. We guide you through:

- Preparing case summaries

- Organizing evidence and correspondence

- Documentation checklists

- Drafting communication with insurers or intermediaries

We help you present a clear, complete case while maintaining objectivity.

Yes.

We provide advisory support on:

- Eligibility for Ombudsman complaints

- Preparing submissions

- Understanding timelines and procedures

We ensure your representation is well-prepared and aligned with guidelines.

Yes — this is a core part of our mission.

We offer:

- Policy interpretation services

- Coverage and exclusion analysis

- Contract advisory

- Documentation audits

- Claims readiness assessments

Most disputes can be avoided with the right knowledge and preparation.