Insurance Solutions for Farmers & FPOs

Our Mission for Farmers and FPOs

Why Partner with My Insurance Tribe

Independent & Knowledge-Driven : We offer unbiased education and consultancy — no policy sales, only empowerment.

Led by Experience : Founded by Dr. Amulya Mala Doddigarla, Ph.D. (Insurance Solvency), who has worked with institutions like CESS and conducted capacity-building programs for FPO leaders and farmer groups.

Holistic Approach: We combine education, consultancy, and claims advisory to strengthen farmers’ confidence and financial resilience.

Community Focus: We believe insurance literacy is a key enabler of inclusive and sustainable rural development.

Insurance Awareness and

Capacity Building

We conduct training programs, workshops, and digital learning sessions to build awareness about agricultural and allied insurance schemes such as:

- Pradhan Mantri Fasal Bima Yojana (PMFBY)

- Restructured Weather-Based Crop Insurance Scheme (RWBCIS)

- Livestock and Aquaculture Insurance

- Farm Equipment and Asset Protection

Our sessions simplify complex policy terms, claim procedures, and eligibility criteria, enabling farmers and FPO executives to make informed decisions and avoid common pitfalls.

Claims Consultancy and

Grievance Assistance

We assist farmers and FPOs in preparing and processing claims — ensuring timely settlement and transparency. Our consultancy model helps reduce disputes and build trust between policyholders and service providers.

hasgy

Advisory Services for FPOs and

Agri-Enterprises

Through our consultancy services, we work with FPO leaders, NGOs, and agri-startups to:

- Assess risk exposure and insurance needs for member farmers

- Develop insurance adoption strategies aligned with local crops and weather conditions

- Facilitate coordination with implementing agencies and insurers

- Support documentation and compliance processes

Our sessions simplify complex policy terms, claim procedures, and eligibility criteria, enabling farmers and FPO executives to make.

Research, Training, and

Policy Support

In partnership with research institutions, cooperatives, and government bodies, we undertake impact studies, awareness campaigns, and training programs on crop and weather insurance. Our goal is to provide data-driven insights that influence better policy design and stronger implementation at the grassroots level.

My Insurance Tribe

Why Partner with Us

We offer unbiased education and consultancy — no policy sales, only empowerment.

Founded by Dr. Amulya Mala Doddigarla, Ph.D. (Insurance Solvency), who has worked with institutions like CESS and conducted capacity-building programs for FPO leaders and farmer groups.

We combine education, consultancy, and claims advisory to strengthen farmers’ confidence and financial resilience.

We believe insurance literacy is a key enabler of inclusive and sustainable rural development.

Partner With Us

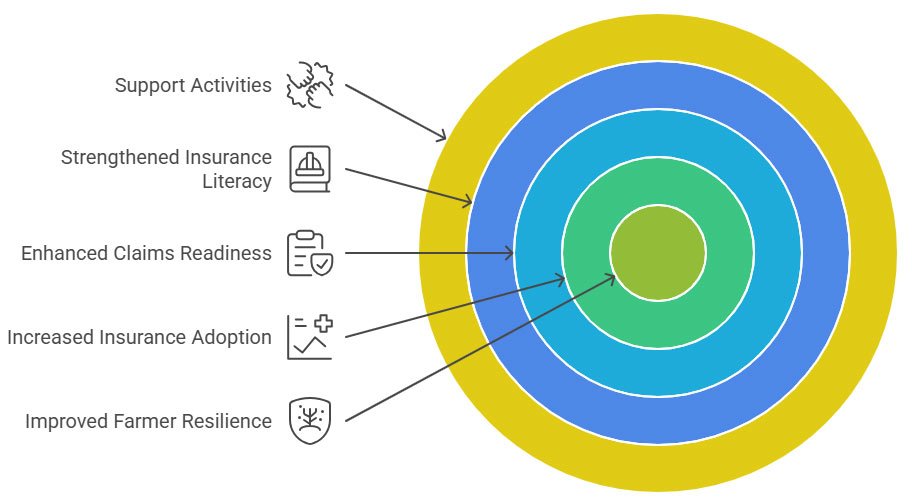

Let’s work together to:

Let’s work together to:

• Strengthen crop insurance literacy

• Build claims readiness

• Improve adoption of PMFBY, RWBCIS, livestock and asset insurance

• Conduct district-level training and awareness programs

• Support farmers with transparent, practical, and trusted advisory

Consultnacymit2025@gmail.com

FAQ's

We don’t enroll farmers directly, but we guide them through the entire process, explain eligibility, documentation, timelines, and help FPOs coordinate with implementing agencies so farmers can enroll correctly and confidently.

Yes. We work closely with FPO leaders to assess local crop patterns, climate risks, and operational needs. We then help create insurance adoption strategies that fit the community’s real-world challenges.

Absolutely. Our claims consultancy team assists in preparing documentation, tracking claim progress, and reducing delays or rejections. We help farmers and FPOs get fair, transparent, and timely settlements.

Yes. Our capacity-building sessions are fully customizable depending on the region, crops, weather risks, and the insurance schemes available locally. We tailor each program to ensure it’s practical and easy to apply.

We work with FPOs, cooperatives, NGOs, SHGs, agri-startups, CSR teams, research institutions, and district authorities. Any organization supporting farmers is welcome to partner with us.

FAQ's

We don’t enroll farmers directly, but we guide them through the entire process, explain eligibility, documentation, timelines, and help FPOs coordinate with implementing agencies so farmers can enroll correctly and confidently.

Yes. We work closely with FPO leaders to assess local crop patterns, climate risks, and operational needs. We then help create insurance adoption strategies that fit the community’s real-world challenges.

Absolutely. Our claims consultancy team assists in preparing documentation, tracking claim progress, and reducing delays or rejections. We help farmers and FPOs get fair, transparent, and timely settlements.

Yes. Our capacity-building sessions are fully customizable depending on the region, crops, weather risks, and the insurance schemes available locally. We tailor each program to ensure it’s practical and easy to apply.

We work with FPOs, cooperatives, NGOs, SHGs, agri-startups, CSR teams, research institutions, and district authorities. Any organization supporting farmers is welcome to partner with us.