Insurance Solutions for MSMEs

Micro, Small, and Medium Enterprises (MSMEs) form the heartbeat of India’s economy — fueling innovation, employment, and local development. Yet, many MSMEs remain underprepared for unforeseen events such as fire, natural calamities, cyber incidents, or health crises that can disrupt operations and impact livelihoods.

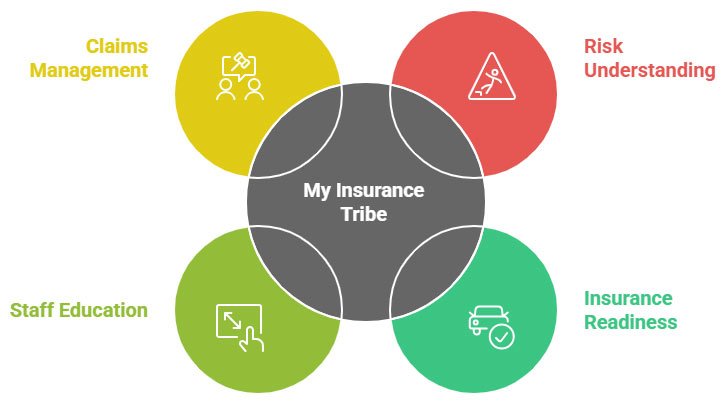

At My Insurance Tribe, we don’t sell insurance policies — we build insurance confidence. Our goal is to educate, guide, and empower MSME entrepreneurs to understand risk, choose wisely, and manage insurance decisions strategically.

We partner with MSMEs as consultants, trainers, and advocates — ensuring they are well-informed, compliant, and protected through the right knowledge and expert advisory.

Our Mission for MSMEs

To build risk-smart, financially resilient enterprises through knowledge, training, and transparent consultancy — enabling small businesses to grow sustainably, confidently, and compliantly.

At My Insurance Tribe, we believe that insurance literacy is business strength. A well-informed MSME is not just insured — it is empowered.

Why MSMEs Trust My Insurance Tribe

Independent & Ethical Advisory : We are not tied to any insurer. Our only commitment is to your knowledge, compliance, and confidence.

Led by Expertise : Founded by Dr. Amulya Mala Doddigarla, a Ph.D. holder in Insurance Solvency with 25+ years of experience across industry, academia, and regulatory domains.

Holistic Approach: Our approach combines education, consultancy, and claims support to strengthen MSME resilience.

Community-Driven Mission: We are building a tribe of informed MSME leaders who see insurance as a strategic tool for growth — not a mere transaction.

Risk Education & Capacity Building

We conduct interactive workshops, webinars, and advisory sessions to help business owners and teams understand the insurance landscape — from regulatory frameworks to claims processes. We simplify complex concepts like risk transfer, solvency, and coverage analysis into actionable learning.

- Evaluating existing policies for adequacy and gaps

- Preparing risk assessment reports

- Advising on claim readiness and documentation best practices

Claims Consultancy Services

When claims arise, MSMEs often struggle with documentation, delays, and disputes. Our claims consultancy team assists in claim preparation, communication with intermediaries, and settlement tracking — ensuring transparency and fairness at every stage.

Strategic Insurance Consultancy

Through our consultancy model, we help MSMEs identify potential risk exposures and map them to suitable insurance solutions available in the market. We assist in:

- Evaluating existing policies for adequacy and gaps

- Preparing risk assessment reports

- Advising on claim readiness and documentation best practices

- Supporting compliance with IRDAI and statutory requirements

Research & Advisory for MSME Ecosystem

We collaborate with institutions, industry bodies, and development agencies to conduct research and impact studies on insurance adoption among MSMEs — supporting policy recommendations, capacity-building programs, and pilot initiatives.

Partner With Us

Whether you are a startup, a growing enterprise, or an MSME cluster leader, we can help you:

- Understand your business risk landscape

- Evaluate insurance readiness and compliance

- Build staff capacity through education

- Manage and resolve claims effectively

Collaborate with My Insurance Tribe — and let’s create a future where every small business stands strong against risk, powered by knowledge and trust.

FAQ's

No. We are not insurance sellers or intermediaries. My Insurance Tribe provides independent education, consultancy, and claims support so MSMEs can make informed and confident insurance decisions.

We assess your business risks, review existing policies, identify coverage gaps, and guide you on suitable insurance solutions available in the market. Our advice is insurer-neutral and focused purely on your protection needs.

Yes. Our claims consultancy team helps with documentation, communication, claim preparation, and follow-up. We ensure transparency and track progress so that MSMEs get fair and timely settlements.

Absolutely. We conduct customized workshops, webinars, and capacity-building programs for MSME owners, staff, and cluster groups. Training can be online or on-site depending on your need.

We support all small businesses including startups, micro enterprises, local units, self-employed clusters, and registered MSMEs. Any enterprise that wants to strengthen risk readiness and insurance literacy is welcome.

FAQ's

No. We are not insurance sellers or intermediaries. My Insurance Tribe provides independent education, consultancy, and claims support so MSMEs can make informed and confident insurance decisions.

We assess your business risks, review existing policies, identify coverage gaps, and guide you on suitable insurance solutions available in the market. Our advice is insurer-neutral and focused purely on your protection needs.

Yes. Our claims consultancy team helps with documentation, communication, claim preparation, and follow-up. We ensure transparency and track progress so that MSMEs get fair and timely settlements.

Absolutely. We conduct customized workshops, webinars, and capacity-building programs for MSME owners, staff, and cluster groups. Training can be online or on-site depending on your need.

We support all small businesses including startups, micro enterprises, local units, self-employed clusters, and registered MSMEs. Any enterprise that wants to strengthen risk readiness and insurance literacy is welcome.